Key facts

TYPE

End-to-end development

PRODUCT

Mobile App

INDUSTRY

Financial Services

Summary

Crédito de la Casa tapped into our technical and managerial expertise to get a top-notch solution and benefitted from our efficiencies and best practices, leveraging their people and processes.

01.The Client

Crédito de la Casa is a Uruguayan company dedicated to providing financial solutions to its clients.

It was established in 1993 as a credit management company operating in the personal credit sector. It began by handling purchase orders in construction material shops and later expanded its services to include cash loans.

From its inception to today, Crédito de la Casa has experienced steady growth throughout Uruguay. This growth is attributed to a work methodology aimed at service excellence, grounded in human values when dealing with customers and commercial ethics.

Uruguay

+ 200 service points nationwide

+ 10,000 affiliated businesses

02.The Challenges

They are undergoing a digital and technological transformation, including enhancements in the company's sales channels to sell its products.

As part of this transformation, they planned to launch the "Commerce App," a mobile application designed to enhance the experience for businesses and end customers using "Compra Ágil" (a BNPL solution, which is their core business), a method by which Crédito de la Casa allows customers to buy on credit from affiliated companies.

In this context, they were searching for a technological partner to develop the "Commerce App" to enhance this experience.

They were looking for a committed and trusted partner to close a tech gap in mobile while their IT team would focus on the backend.

The primary key for them was schedule and budget.

After many meetings with the client, we defined four main issues to be addressed by the digital solution to ensure it will seamlessly achieve the needs of the target users and drive positive business outcomes.

Intuitive and user-friendly design.

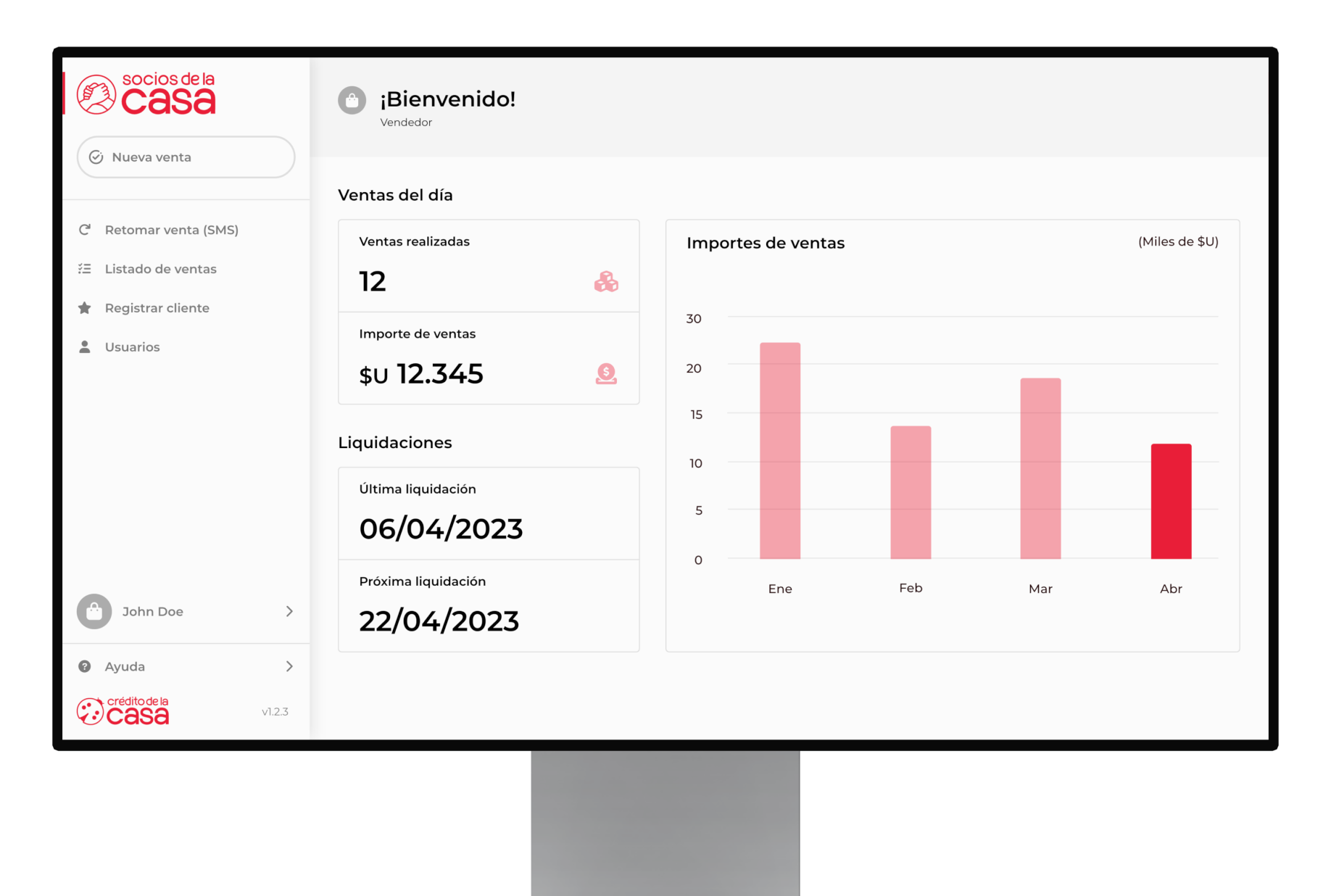

Dashboard with relevant metrics.

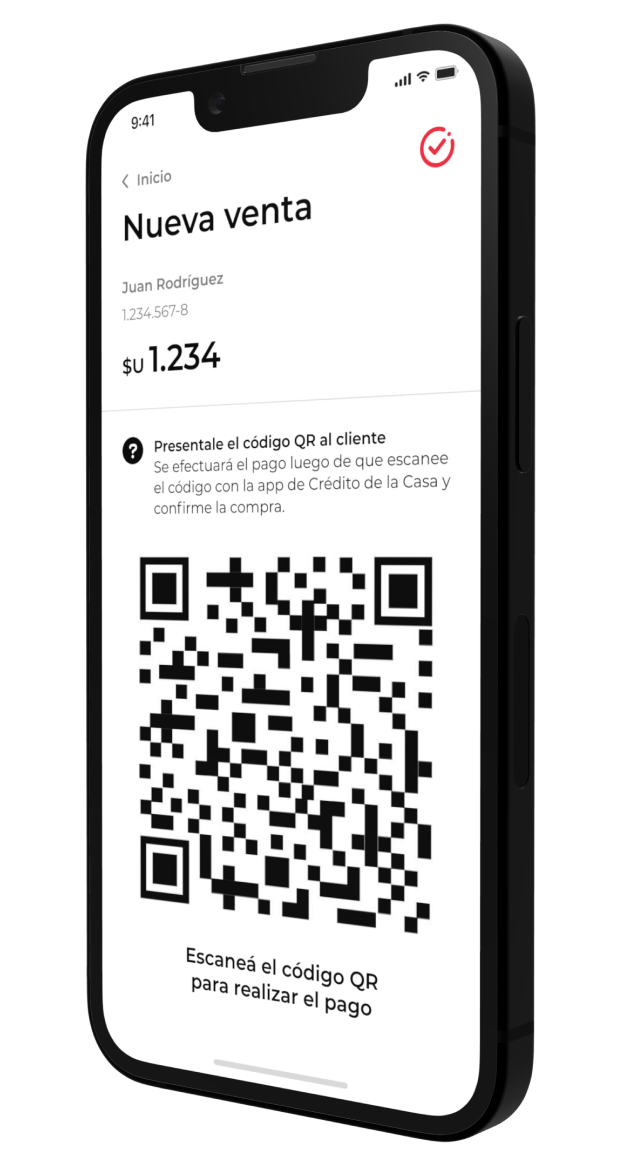

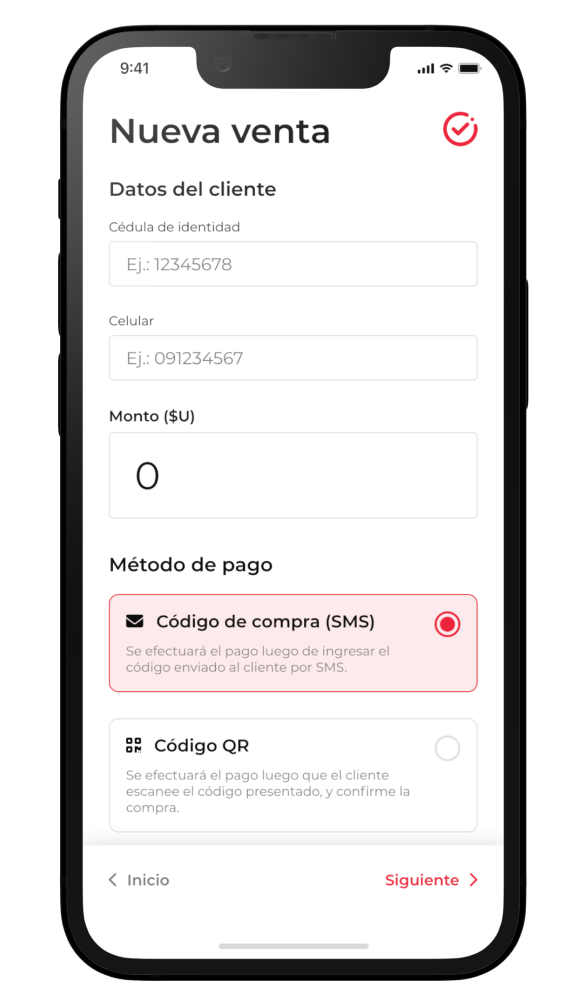

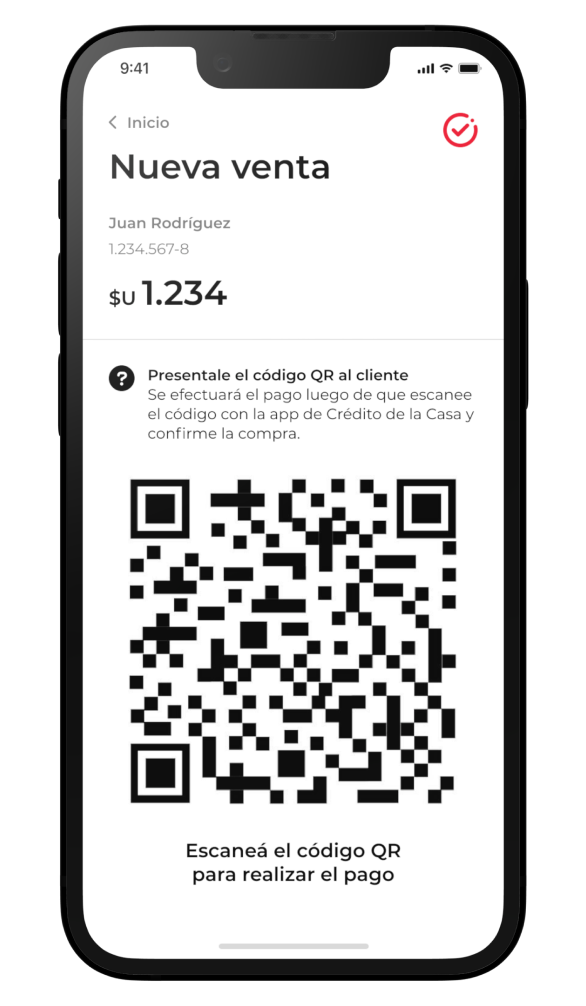

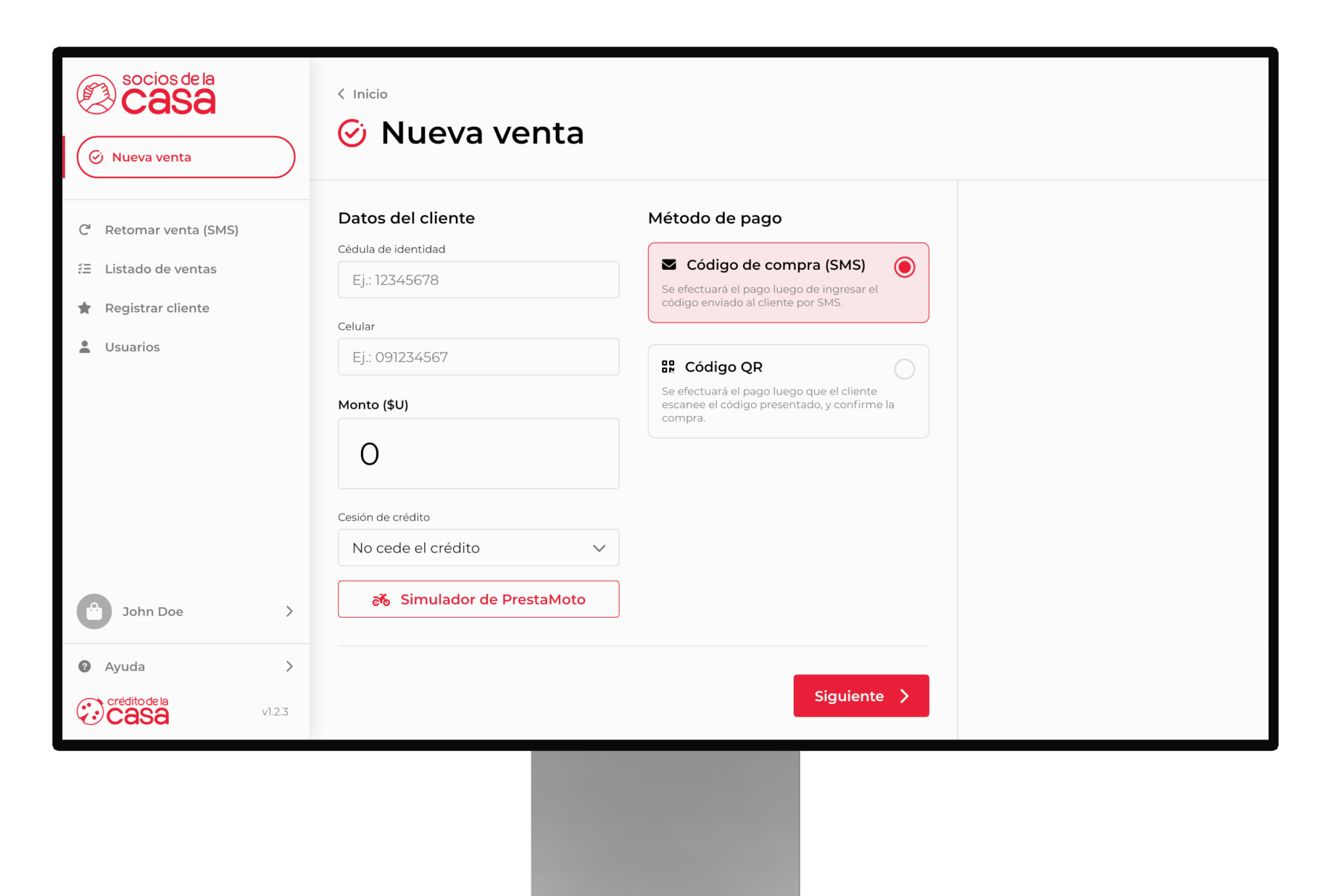

Two payment flows were to be considered: QR codes or sending a code via SMS.

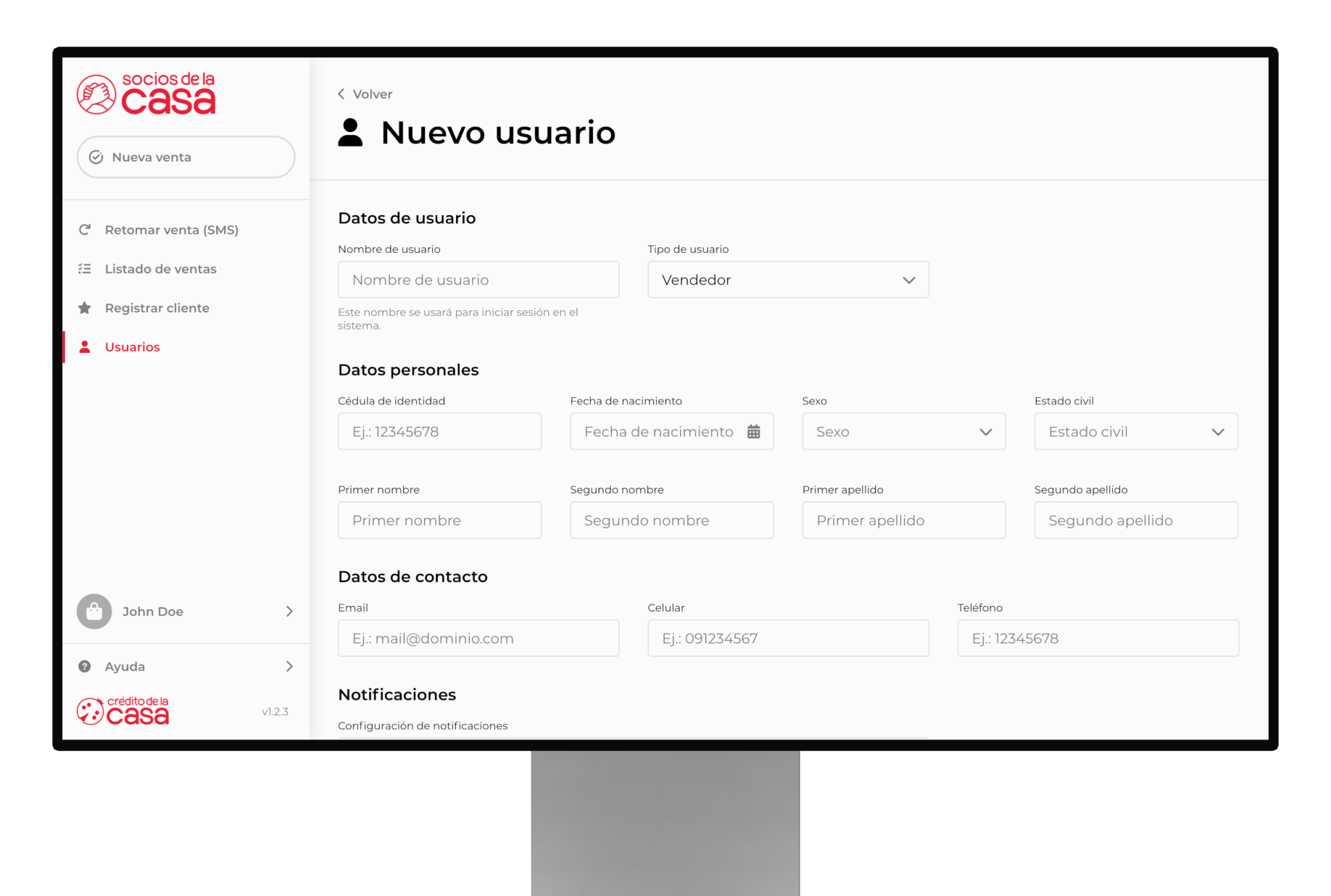

Roles and permissions: two roles were defined for the App, "Administrator" and "Seller," and a third one, Supervisor, for the web.

03.The Solution

The app's primary function was to facilitate the management of purchases in stores participating in the "Compra Ágil" program, making it more comfortable and intuitive for both the vendor and the end customer.

Crédito de la Casa's end customer already has an app that allows reading the QR code to make payments. For this reason, the project involves only the development of the app geared towards merchants, which will offer two payment flows for the customer to purchase.

Through a UX discovery, our design and development team, working closely with the client, sought to thoroughly understand the problem, context, and user needs before creating a concrete solution. We were looking to have a design aligned with current standards but being conceived from and for the final user.

We created high fidelity prototypes to visualize the user interface, enabling feedback, early testing, and client approval before starting to develop.

TECHNOLOGIES

Mobile app

The Commerce App would only have two roles with different permission levels based on their function.

On the one hand, the "Seller" role would allow the user to sell through the QR Payment and SMS Code Payment options.

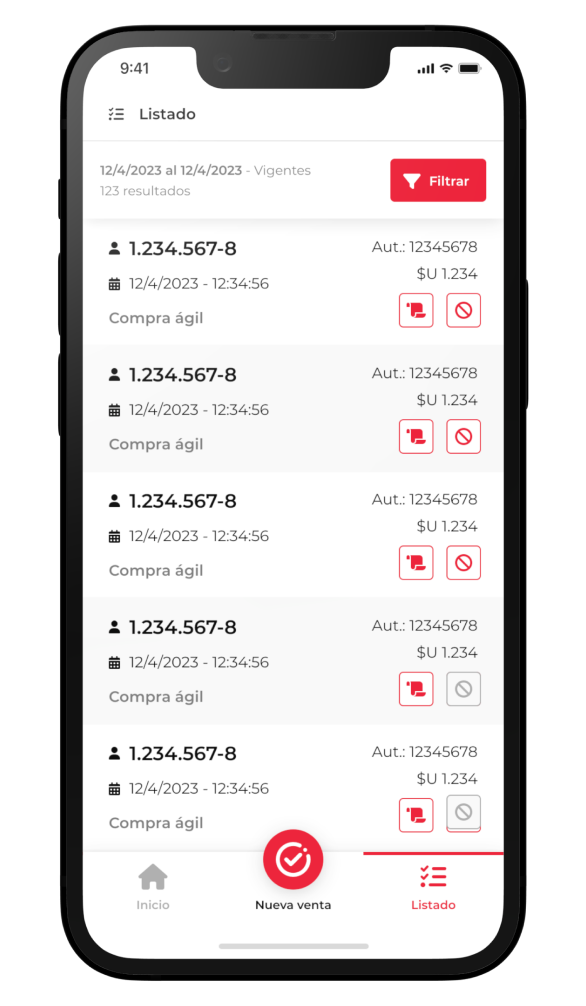

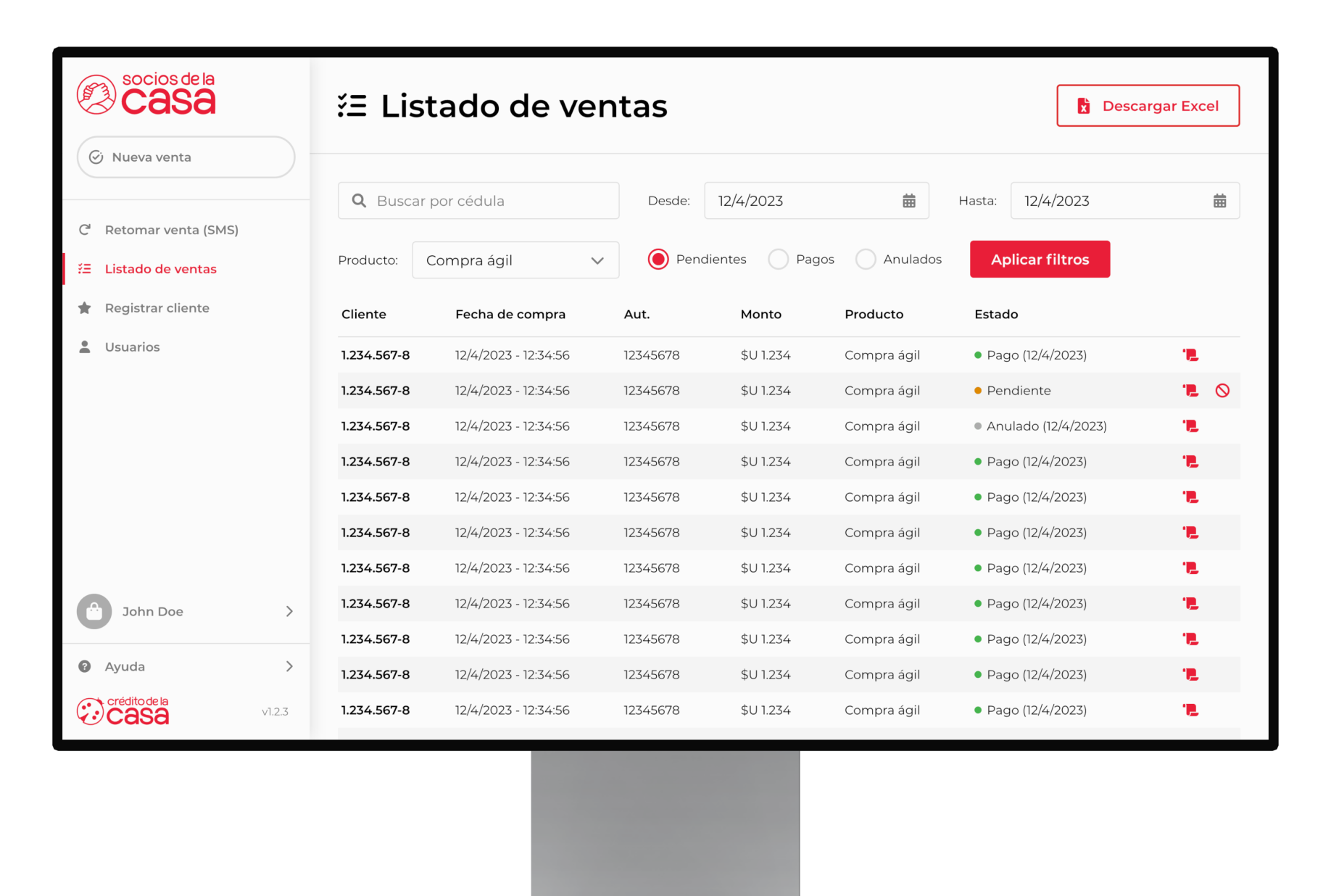

On the other hand, the Administrator role would enable business owners or supervisors to create new sellers, void purchases, and access a Dashboard with relevant sales metrics made in the "Compra Ágil" mode.

The main features that were covered are the ones listed below:

- Authentication:

- Login.

- Logout.

- Roles & Permissions:

- Seller.

- Administrator.

- Reports & Dashboard:

- Daily sales: amount, quantities, profits.

- Last quarter sales.

- Payments.

- Payment options flow

- QR Payment.

- SMS Code Payment.

Web app

On top of the app, we were in charge of revamping the current Commerce web for this BNPL solution to adapt the look and feel to one of the mobile apps we were working on and add the QR payment option. The main purpose of this update was to create an omnichannel user experience for the sellers.

04.The Results

We delivered on time and within budget, which were the client's main aim, but without sacrificing quality or features.

By using the Agile methodology, we gave transparency to the client, and it was easy for them to optimize the planning and follow up on advances.

The team worked closely with the stakeholders regarding the backlog for each sprint and the potential roadblocks to ensure we met the deadline.

Their IT Leader emphasized how Switch has empowered the in-house team by sharing the latest technologies, tools, and methodologies.

Testimonial

In all my years in the business the usual rule is that you have to put pressure on the providers to meet the promised dates. In this case, Switch was the one putting pressure on our team to deliver on time. Amazing disposition of all the team assigned to the project.

- FABRIZIO CANTONI

CIO & CTO, Crédito de la Casa